Paytm for Business

Description of Paytm for Business

Paytm for Business is a mobile application designed for merchants and business owners to facilitate the collection of payments from customers. This app, widely recognized in the Indian market, provides a seamless way to accept various payment methods, making it an essential tool for small businesses, freelancers, and delivery services. It is available for the Android platform, allowing users to download Paytm for Business easily.

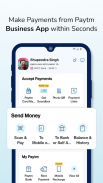

The app supports multiple payment methods, enabling users to accept payments through UPI apps, debit and credit cards, net banking, and the Paytm Wallet. This flexibility ensures that merchants can cater to the diverse preferences of their customers, enhancing the overall payment experience. Additionally, the app allows merchants to receive payments via mobile number, QR code, or card machine, providing a comprehensive solution for payment collection.

One of the notable functionalities of Paytm for Business is the ability to create payment links. Merchants can generate these links within the app and share them via chat or email, making it convenient for customers to complete transactions. This feature is particularly beneficial for businesses operating online or those that engage with customers through digital channels.

The app also offers an All-In-One QR Code, which simplifies the payment process further. By obtaining this QR code, merchants can display it prominently in their stores, allowing customers to make payments quickly and effortlessly, regardless of the payment method used. This feature not only speeds up the transaction process but also encourages cashless payments.

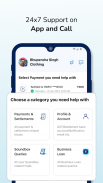

To assist businesses in managing their finances, Paytm for Business provides real-time payment tracking. Merchants receive notifications via SMS and push notifications each time a payment is received. This feature allows business owners to stay informed about their transactions and monitor their financial activities effectively. The app also includes tools for initiating refunds, viewing bank transfers, and gaining insights into business performance.

Instant bank settlements are another key aspect of the Paytm for Business application. Merchants can choose their preferred frequency for settlements or manually settle the amount themselves. This flexibility ensures that business owners have control over when they receive funds in their bank accounts, enhancing cash flow management.

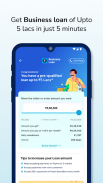

For those in need of financial support, the app serves as a facilitator for personal and business loans. Personal loans can range from ₹10,000 to ₹2.5 lakh, with repayment terms between 3 to 60 months. The annual percentage rate (APR) varies from 10.5% to 48%, and the loan processing fee ranges from 0% to 6%. Business loans are also available, with unsecured loans up to ₹10,00,000 and a tenure of 3 to 36 months. Applicants can benefit from a straightforward digital loan process with no prepayment charges, making it accessible for various business needs.

The app collaborates with several lending partners, ensuring that users can connect with reputable financial institutions for their borrowing needs. This partnership approach enhances the reliability of the loan services provided through the app.

Paytm for Business features door-to-door shipping, ensuring that products reach customers promptly. The application has established partnerships with major courier services, which guarantees timely delivery across the country. This capability is especially beneficial for businesses that rely on quick logistics to meet customer expectations.

The user interface of the app is designed for ease of use, allowing merchants to navigate through its features efficiently. Business owners can access all functionalities from a single platform, streamlining their payment processes and financial management tasks.

In addition to its core features, Paytm for Business offers valuable insights that can help merchants make informed decisions about their operations. By analyzing transaction data, business owners can identify trends and opportunities for growth, allowing them to adapt their strategies accordingly.

With its wide array of features aimed at simplifying payment collection and enhancing business operations, Paytm for Business has become a trusted tool for millions of businesses. The app's ability to accept multiple payment types, track transactions in real-time, and facilitate loans makes it a comprehensive solution for modern merchants.

For anyone looking to improve their payment processing capabilities and financial management, downloading Paytm for Business can be a significant step forward. Through its user-friendly interface and robust functionalities, this app equips business owners with the tools they need to thrive in a competitive marketplace.

Website - https://business.paytm.com